A business venture can be thrilling, especially for Australian solopreneurs. One of the most important legal considerations for solopreneurs is the legal structure of business. Your decision will have a significant impact on the way your firm operates, your tax liabilities, and your personal liability. In this thorough book, we’ll delve into the legal issues that affect solopreneurs while examining several business structures and their advantages and disadvantages. Understanding these possibilities is crucial whether you’re starting off or looking to review your present structure.

Understanding the Legal structure of business in Australia

Let’s quickly go over the most prevalent business structures in Australia before we get into the technicalities of picking the best legal structure for your solopreneurship:

- Sole Trader: The simplest kind of organization is one in which you, the solopreneur, are the sole proprietor and manager of the company. Both decision-making and financial accountability for the company’s debts and liabilities are entirely under your control.

- Company: A company’s owners (shareholders) are not considered to be part of it legally. It provides its shareholders with limited liability, which means that business debts often have no effect on their personal assets.

- Partnership: A partnership is when two or more people jointly own and run the business. As a limited or general partnership, it can provide various levels of liability protection.

- Trust: On behalf of trust beneficiaries, a trustee manages the company’s operations and assets. Although adaptable, this structure can be challenging to erect and keep in place.

Comparing the Legal Structure of Business for Solopreneurs

Sole Trader: The One-Person Show

You may be lured to the ease of being a sole trader if you are a solopreneur. What you need to know is as follows:

Pros:

- Full Control: You make all the decisions, which can be empowering for many solopreneurs.

- Minimal Setup: Setting up as a sole trader is straightforward and cost-effective.

- Tax Benefits: You can access individual tax concessions and deductions.

Cons:

- Unlimited Liability: You are personally liable for all business debts, potentially putting your personal assets at risk.

- Limited Growth: Expanding the business might be challenging without additional capital.

Key Legal Considerations When Choosing a Structure:

Now that you are familiar with the sole proprietor structure, let’s examine some important legal factors to take into account while choosing the best form for your company:

- Liability: The level of personal liability you’re comfortable with is a crucial factor. Sole traders and partnerships offer less protection, while companies provide limited liability.

- Taxation: Consider the tax implications of your chosen structure. Different structures have varying tax obligations and benefits. Consulting with a tax advisor is advisable.

- Scalability: If you plan to grow your business, think about the scalability of your chosen structure. Companies, for example, are often more suitable for expansion.

- Compliance: Each structure comes with its own set of regulatory requirements. Ensure you can meet these obligations without undue complexity.

- Exit Strategy: Think about your long-term plans for the business. Some structures are more conducive to selling or passing on the business.

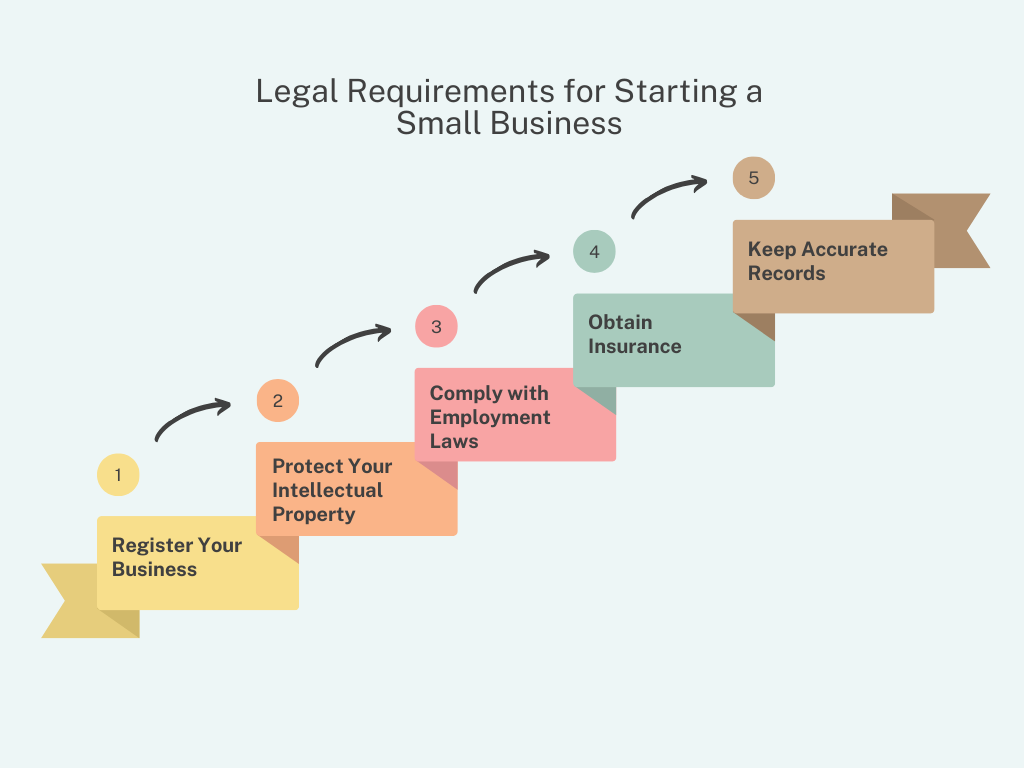

Legal Requirements for Starting a Small Business

Small business startups must adhere to a number of legal criteria. The following are some of the most crucial legal criteria that sole proprietors should be aware of:

- Register Your Business: Solopreneurs need to register their business with the appropriate state and local agencies. This includes obtaining a business license, registering for state and local taxes, and obtaining any necessary permits.

- Protect Your Intellectual Property: Solopreneurs need to protect their intellectual property by registering trademarks, copyrights, and patents. This will prevent others from using their intellectual property without permission.

- Comply with Employment Laws: If solopreneurs plan to hire employees, they need to comply with employment laws, such as minimum wage laws, overtime laws, and anti-discrimination laws.

- Obtain Insurance: Solopreneurs need to obtain insurance to protect their business from liability. This includes general liability insurance, professional liability insurance, and workers’ compensation insurance.

- Keep Accurate Records: Solopreneurs need to keep accurate records of their business transactions, including income, expenses, and taxes. This will help them to comply with tax laws and to make informed business decisions.

Bottom Line

A crucial decision that might affect the future of your firm is selecting the appropriate legal form for your solopreneurship. Consider with a specialist before starting this path to make sure your decision fits your needs and goals.

In conclusion, solopreneurs should focus on their business structure, liability, taxation, scalability, compliance, and exit strategy while making legal decisions. When carefully considered, these variables will assist you in reaching a choice that will provide the groundwork for your company’s success.

Keep in mind that there are resources available to you, such as law assignment help online, which can provide you more insight into the legal aspects of business as you seek legal advice or support with comprehending corporate structures.

Are you prepared to advance in your solopreneurship endeavors? Get professional guidance on managing the legal intricacies of business formations by contacting us right away. Assignment Unlocked is your partner in commercial law assignment excellence, whether you’re beginning from scratch or thinking about a change.